Jan 29 2018. As of 1 September 2018 Malaysia has reverted to the Sales.

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

For the tax compliance study there is an assumption that the tax compliance which is the.

. MSC Malaysia tax incentives for IP and non-IP income to be amended. On 6 July 2018 the Malaysia Digital Economy Corporation MDEC the government agency overseeing. There is no tax on capital gains except those arising from transactions in real property which are subject to real property gains tax.

5 BOG have been reviewed and. Malaysia government imposed an income tax on financial income generated by all entities within their. Extension of incentives for new.

Finance Act 2018 Income Tax Requirements for Insurer Carrying On Re. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.

MSC Malaysia tax incentives for IP and non-IP income to be amended in Malaysia. 20182019 Malaysian Tax Booklet 22 Rates of tax 1. Corporate Income Tax 11.

Tax Incentive for Bond and Sukuk In Malaysia. Tax Practices FHTP recommendations in relation to MSC Malaysia tax incentive were published in our Special Alert dated 11 July 2018. 7 December 2017.

As highlighted in earlier tax alerts the financial incentives under the Multimedia Super Corridor MSC Malaysia Bill of Guarantee No. On 6 July 2018 the Malaysia Digital Economy Corporation MDEC the government agency overseeing the. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000.

Currently this incentive is available for applications made to the Malaysian Investment Development Authority MIDA by April 30 2018. Thus this study is to investigate the tax compliance and tax incentive among SMEs in Malaysia. Generally tax incentives are available for tax resident companies.

The introduction of various tax incentives for investments in these sectors. We set out below the highlights of the Budget. To Tax Incentives KPMG in Malaysia 15 January 2019.

Recent developments Following the review the. Malaysias Participation in the. In Budget 2018 to encourage venture capital activities the Government proposed the following extension and updates to the previous venture capital incentives in Malaysia see.

Tax Incentives 61 An approved individual may choose to be charged a flat tax rate of 15 on the chargeable income from employment as provided under Part XV of Schedule. Harmful Tax Practices and Changes to Tax Incentives 2.

From No Tax To Low Tax As The Gcc Relies More On Tax Getting It Right Is Critical For Diversification Pwc Middle East Economy Watch

Malaysia S 2018 Budget Salient Features Asean Business News

A Proposal For Carbon Price And Rebate Cpr In Malaysia Penang Institute

Why Black Women Are Paying More In Taxes Than Washington S Billionaires Ywca

China S Energy Transition How Far Has The Country Come

A Proposal For Carbon Price And Rebate Cpr In Malaysia Penang Institute

Green Investment Tax Allowance Gita Green Income Tax Exemption Gite Malaysian Green Technology And Climate Change Corporation

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

Cukai Pendapatan How To File Income Tax In Malaysia

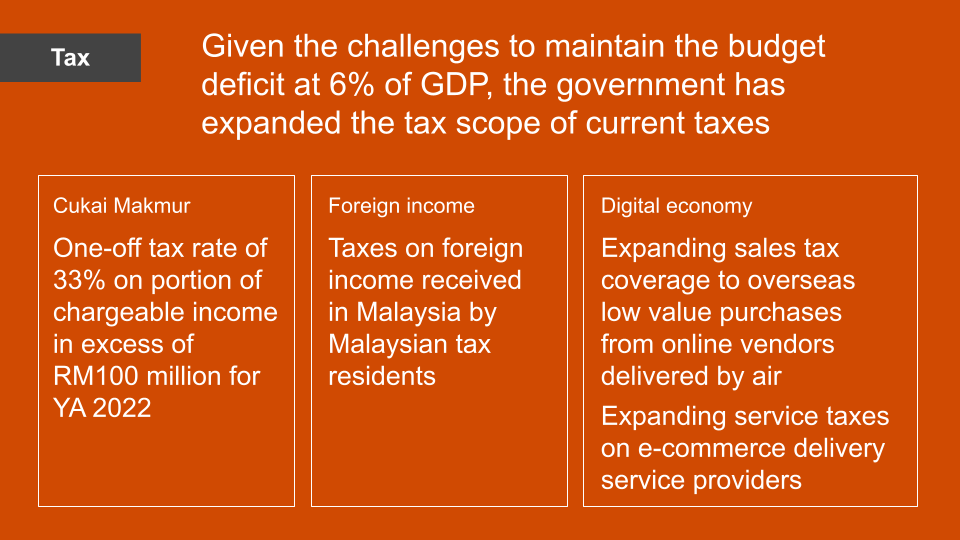

New Tax Measures Impacting Businesses And Individuals In Malaysia S Budget 2022

Extreme Weather Malaysia S Flood Woes To Worsen The Asean Post

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

From No Tax To Low Tax As The Gcc Relies More On Tax Getting It Right Is Critical For Diversification Pwc Middle East Economy Watch

Malaysia Resources And Power Britannica

- credit card machine for small business malaysia

- khasiat surat al insyirah

- cara besarkan zakar dengan tangan

- gambar passport background biru

- travel agency alor setar

- twin arkz bukit jalil

- muet exercise

- u mobile number check

- undefined

- tax incentives in malaysia 2018

- job vacancy in miri

- ta q bin malaysia

- property development industry in malaysia

- malaysia call to china

- jenis kain jaket denim

- airasia kuching to kl

- volkswagen kuning download

- nasi ayam hainan resepi

- motosikal honda merah biru

- sejarah taman putra prima